How policies on the environment, working conditions and social issues influence today's consumers.

London Research and Trustpilot's latest international survey has shown that not only are fashion shoppers more cautious on spending this year, they are also acutely aware of the need to buy items from fashion brands and retailers with strong ethical and sustainability practices.

Fashion brands and retailers now have an opportunity to reach out to consumers who are actively seeking to shop from companies that are kind to the people working in their supply chains, as well as the environment.

Those seeking to market themselves to modern shoppers need to listen to what consumers have revealed they are looking for in sustainable and ethical brands, as outlined in this research.

Five key trends that will define the future of fashion brands

1. Four in five customers are led by ethics

Size and fit are not the only priorities. Fashion brands and retailers need to be aware that treatment of workers across their entire supply chain and environmental footprint are now a vital part of a customer’s purchasing decisions.

More than four in five customers (82%) reveal they would definitely (31%) or probably (51%) stop buying from a brand found to be lacking ethical standards.

2. Shoppers are cautious on spending

The recession looming over the global pandemic is shaping fashion spending habits. Just under three-quarters of consumers (72%) are spending less or the same as they did before.

As befitting markets where many are working from home, casual clothing and leisurewear is the category with the highest proportion of consumers having increased spend (21%). This figure is nearly double that seen in formal wear or luxury items.

3. Fashion shoppers trust reviews and each other

Consumers are eager to seek out fashion brands and retailers with solid ethical and sustainability strategies.

They are getting advice on which brands meet these criteria from many sources, but they trust each other above all else – 89% of consumers have a high or medium trust level in word of mouth and 85% in ratings and reviews.

The levels of high trust placed in word of mouth and reviews are two to three times greater than other sources, such as magazines, advertising and brand websites. The least trusted source is celebrity influencers. People are three times as likely to highly trust ratings as they are a well-known figure touting a fashion product on social media.

4. Fashion shoppers are acting on a brand’s ethical record

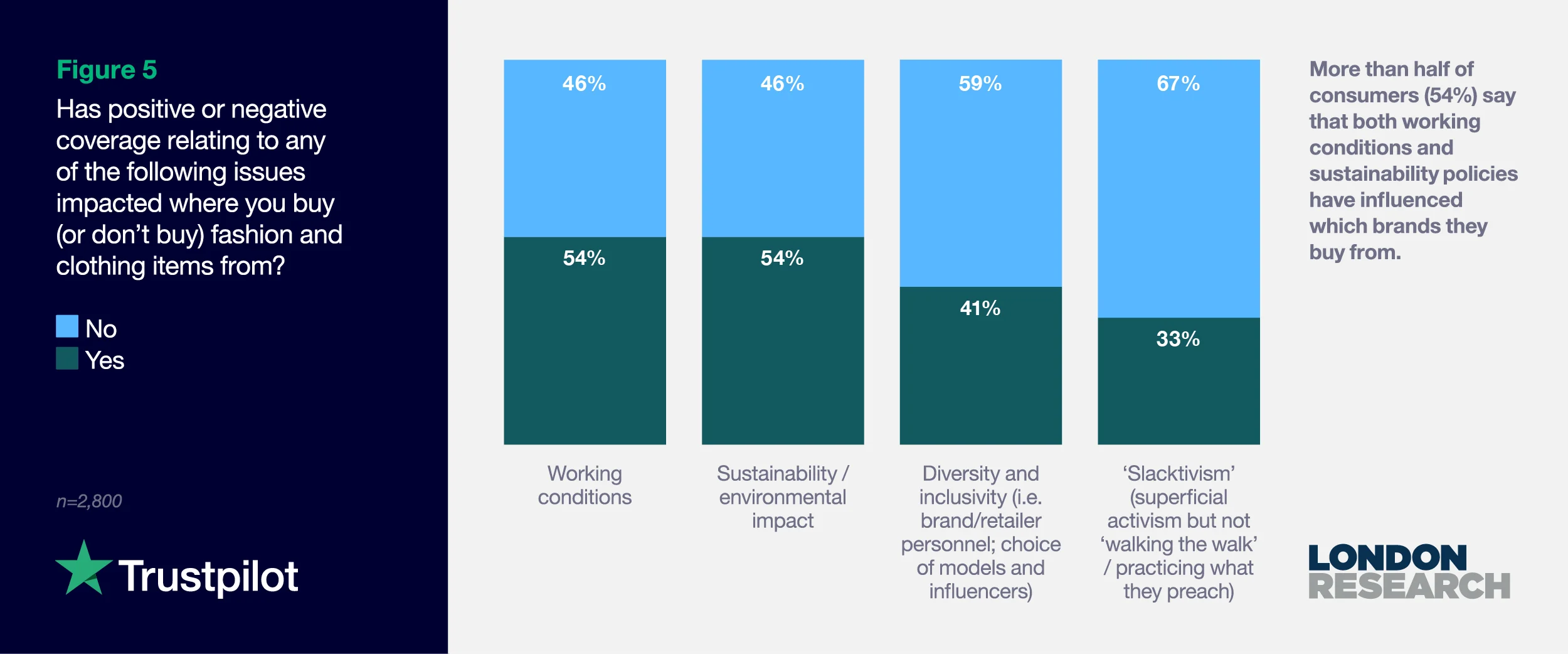

The research found brands must not think of ethics as an issue to be addressed in the future. Shoppers are already acting on their concerns right now. More than half (54%) of consumers say that coverage of working conditions and sustainability policies has influenced where they buy, or don’t buy, fashion items.

Nearly as many (41%) have been steered by coverage of a fashion retailer’s diversity and inclusivity policy and 33% by a brand pretending to be ethical but not backing it up with real action (‘slacktivism’).

Given that consumers trust word of mouth and customer ratings three times or two times (respectively) as much as the media, savvy brands should realize the need to communicate how their ethical and environmental strategies match the modern shopper’s concerns. This way, those credentials are more likely to be reflected in customer conversations and ratings.

5. Brands can tap into consumers’ ethics and sustainability wishlist

Customers have revealed what they want to see from fashion brands and retailers. Joint top spot (46% each) goes to a commitment to good working practices throughout the supply chain as well as to environmentally-friendly packaging. A recycling service (41%) was just behind in third place.

Feeling inspired? Let's dive in!

Introduction – cautious consumers tell brands their values are more important than discounts

Consumers are changing their mindset and behavior when it comes to buying clothes, and the effects are set to be profound for fashion brands and retailers.

The national and local lockdowns caused by the coronavirus pandemic have accelerated a change in attitude among shoppers to be more caring for one another and the environment. Communities have come together to fight a common foe and taken stock of the values they find important to them, which they want to see reflected in the brands they buy from.

This prompted London Research, in association with Trustpilot, to ask fashion consumers in the UK, the US, France, the Netherlands, Italy and Sweden to reveal the importance of brand values around issues such as sustainability, working conditions and diversity. What principles do they expect fashion brands and retailers to live up to?

Just as importantly, how do they know they are truly committed to these causes, and whom do they trust in making those judgement calls?

Sustainability over discounts

Research from McKinsey has already shown lockdown has forced fashion consumers’ priorities to change. They now place the welfare of employees and supply-chain workers, as well as protecting the environment, way ahead of being offered promotions and discounts.

This points to a significant change in consumer priorities, according to fashion writer Olivia Pinnock. She has created a series of events, called The Fashion Debates, through which the industry can come together to discuss how to clean up an industry with a poor record on worker conditions and sustainability.

“We had the sweatshop scandals of the ‘80s and ‘90s but the issue seemed to have been swept under the carpet,” she says.

“Now, though, we’ve got a generation who realize they can’t ethically buy a T-shirt for £5 when there are so many people in the supply chain to pay. There are also a lot of executives who are pushing for real change because they have been shocked by the industry’s record and don’t want to be a part of it any more.”

Pinnock believes the push for change is real and is relying on changing attitudes among shoppers. However, there are two major challenges.

“Fast fashion’s cutting corners on worker rights and the environment has got us all used to cheap clothing,” she explains.

“It’s skewed our perception of cost. Then there’s availability. The vast majority of clothes, outside a pandemic, are bought in stores and it’s only the big chains, who are highly competitive on price, that can afford to roll out chains of shops in every town.”

Consumers are cautious on spend

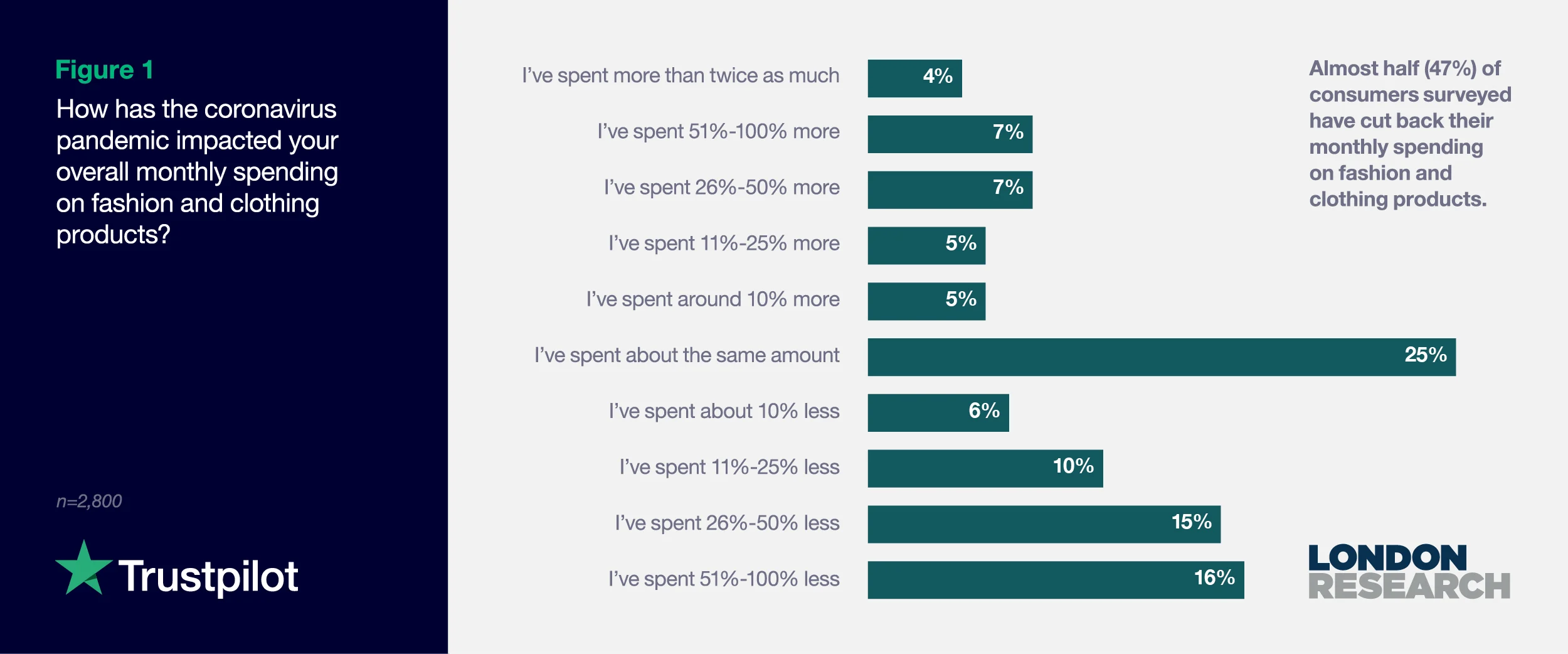

It is not surprising that in the midst of the global coronavirus pandemic, the majority of respondents are not spending more on fashion. Instead, they are maintaining previous spending patterns or cutting back.

On average, 28% of respondents say they are spending more. That leaves exactly a quarter who are spending the same amount as before (25%) and nearly half (47%) who reveal they are cutting back (Figure 1).

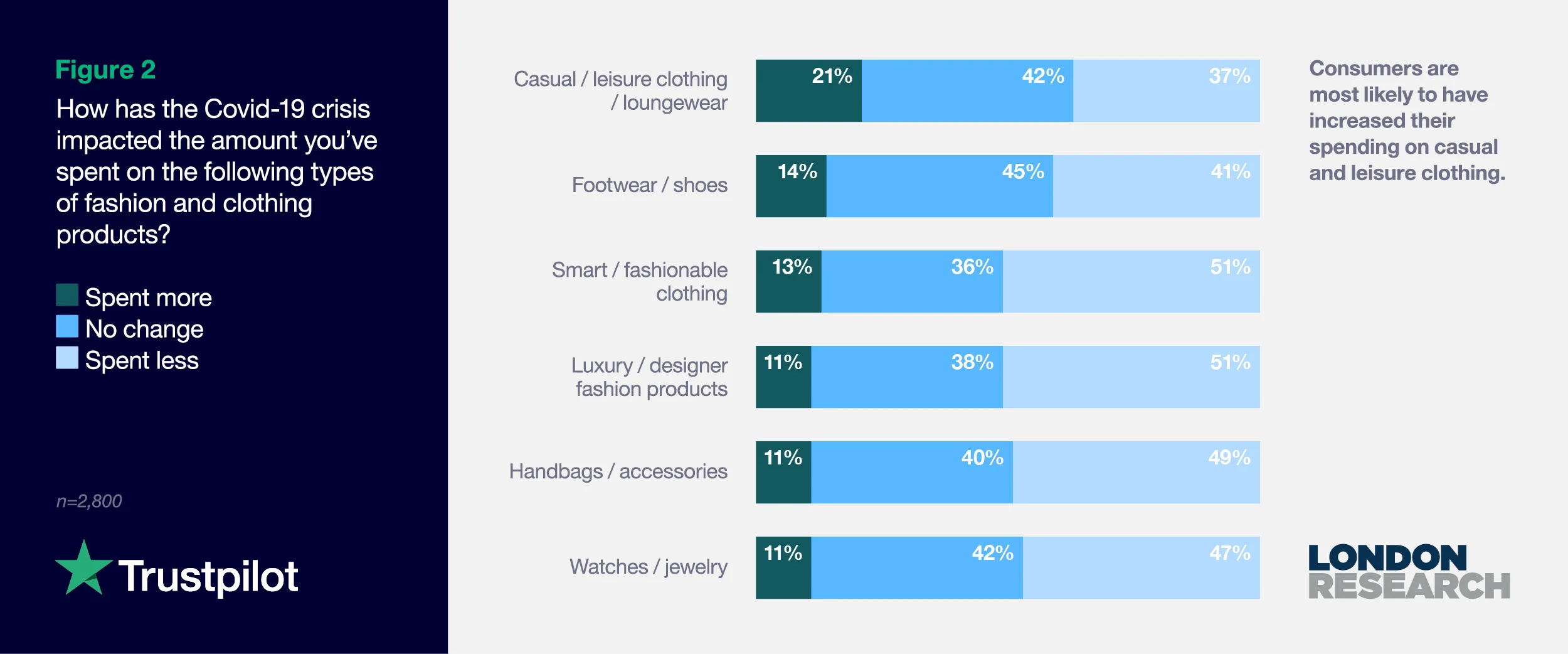

As shown in Figure 2, the standout category for increased spending is casual and leisure clothing (21% of consumers), nearly double the percentage of respondents spending more on luxury apparel (11%) and significantly more than the proportion of consumers increasing their outlay on smart clothes (13%).

Across all international markets surveyed, those going through lockdown and social distancing measures have clearly been prioritizing comfortable attire for home use over spending on formal clothes for the office or expensive luxury items for big nights out.

Consumers in the US are more likely than those in other countries surveyed to be increasing their spending on casual clothes (28%), footwear (20%), smart fashion (20%) and luxury products (15%) (Figure 9, see appendix).

The UK, on track to have its worst economic downturn on record, leads the way for the most cautious shoppers. Just over a fifth (22%) reveal they’ve been cutting fashion spending by more than half (Table 1, see appendix).

More careful? Or more thoughtful?

Consumers are clearly cautious when it comes to fashion spending. It will become clearer when the developing global recession caused by the global pandemic eases whether this is an economic decision or an environmental choice.

Dialing down consumption is what Olivia Pinnock refers to as ‘the elephant in the room’. In addition to looking out for fair trade labels and commitment to ethical and environmental standards, she believes modern consumers will soon realize they need to buy fewer clothes.

It is a message echoed by Laurel Wolfe, VP of Marketing at deferred payment platform Klarna.

“The pandemic has made us all think carefully about how, where and why we shop - whether that's online instead of in-store, or with smaller, local brands.” she says.

“For us, this has meant helping people be mindful consumers, to ensure they buy items they will truly use and love. We have been running campaigns, particularly with thought influencers, echoing the money management advice on our site and asking shoppers to ‘think thrice’. Do I love it, will I use it, is it worth it?”

The message underlines how the market is evolving to row back from the days of fast fashion by being more considerate in how workers in the supply chain are treated and mitigating the industry’s impact on the environment.

People trust ratings and each other, not celebrities and magazines

People are clearly cautious about their spending, given the massive uncertainty hanging over the global economy. With budgets curtailed, consumers are looking to make sure the items they buy are right for them. This no longer means right look, size and price.

As shown through our survey, customers are attracted to brands that share their ethical values and are kind to their workers and the planet.

With ethics, sustainability and environmentalism playing a large part in purchasing decisions, who are people trusting for guidance on purchasing decisions?

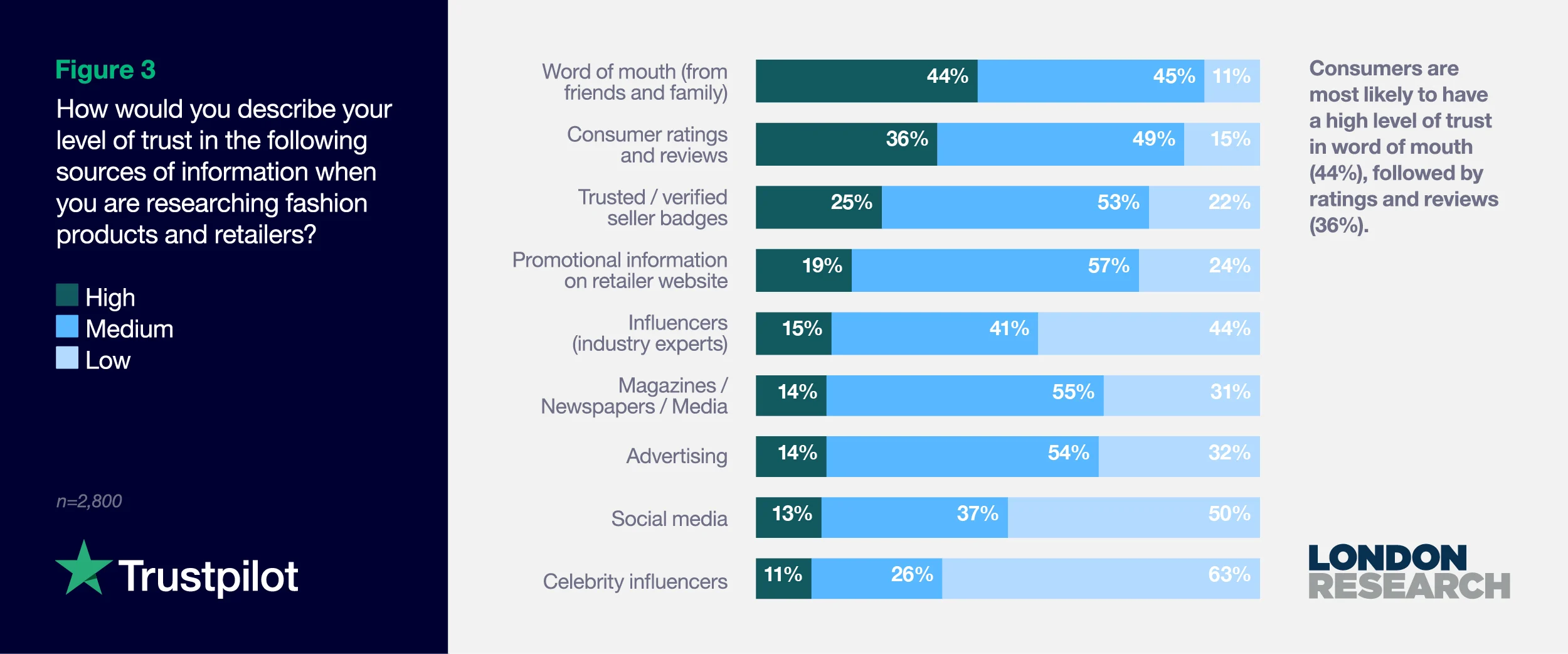

Here, the research provides a resounding answer. Consumers trust one another. Word of mouth from friends and family is the most trusted source, with 44% rating their trust level as ‘high’. Consumer ratings and reviews (36%) is a close second (Figure 3).

In all, 89% of consumers have a high or medium level of trust for word of mouth compared to 85% for ratings and reviews.

The two categories are two or three times as highly trusted as other high-profile sources of fashion information, such as magazines, advertising and social media.

Fashion is an industry filled with well-known designers, models and celebrities who are reported on daily for what they are wearing. However, a key takeaway from the research is that celebrity influencers are poorly trusted as a source of information by nearly two in three consumers (63%).

The research could not be any clearer. Consumers want to make the right decision on fashion, for fit, price and look as well as sustainability and ethics. When it comes to making these decisions, they trust one another’s spoken advice or ratings much more highly than the world of social media and advertising where brands pay a fortune hoping to be noticed.

The Savile Row Company website, displaying the company's Trustpilot rating. This research shows that ratings and reviews, along with word of mouth, are the most trusted sources of information.

The US and Italy stand out as the markets where reviews are most highly trusted (43% of consumers) (Figure 10, see appendix).

Sweden and the Netherlands show the highest trust for word of mouth, for nearly half (49% and 48%, respectively) of consumers (Figure 10, see appendix).

Customer loyalty depends on ethics

Everyone needs clothes and it is fair to say that the driving force in purchasing decisions will depend on garments matching an individual’s sense of style and budget. Increasingly, however, image and price point are being joined by a new criterion. Customers want to know a business shares their values.

More of us want to know a business is run ethically and that it tries its best to ensure people in its supply chain are treated with respect and paid properly, while attention is paid to sustainability.

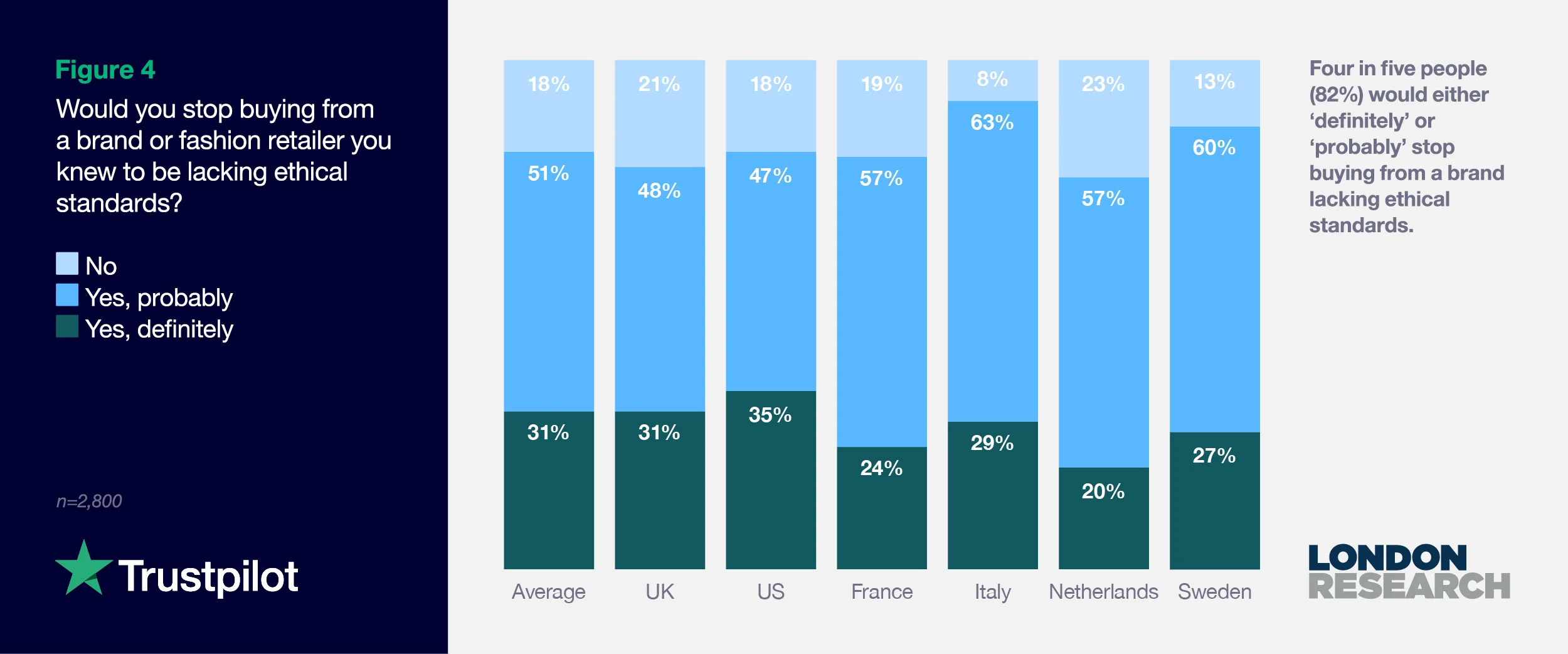

One of the major takeaways from this research is that more than four in five customers (82%) would either ‘definitely’ (31%) or ‘probably’ (51%) stop buying from a brand that was found to lack ethical standards (Figure 4).

The finding should serve as a warning to brands who have yet to put ethics at the heart of their brand strategy. While nearly a third would definitely withdraw their business if non-ethical practices were discovered within the business or wider supply chain, half of the market would consider it.

This is not only a hypothetical question. For any fashion brand wondering when the market will evolve to a point where bad press around their ethics will lose them customers, the answer is we are already there.

More than half of consumers (54%) say that coverage of working conditions and sustainability policies has influenced which brands they buy or don’t buy fashion items from (Figure 5). Nearly as many have been steered by a fashion retailer’s diversity and inclusivity policy (41%) and 33% by a brand pretending to be ethical but not backing it up with real action (‘slacktivism’).

Sophie Slater, who co-founded online women’s ethical fashion business Birdsong, is not surprised by the findings. The company’s workers in London are paid the London Living Wage to produce garments made from organic cotton which are packed by a charity supporting adults with learning difficulties. Protecting staff from Covid meant closing down production, which has relied on customers accepting delays in deliveries because ethical fashion is not fast fashion.

“We’ve seen fashion businesses talk about sustainability for the past few years but the last year or so has definitely seen a rise in people thinking about ethics,” she says.

“People have seen how workers are treated in sweatshops in Leicester (in the UK) by well-known brands… there’s been a lot of bad press for fast fashion. We rely on good press and social media to get our message out to people who are motivated by social inclusion and treating people ethically and so will pay a little more for clothes made by people paid the London Living Wage.”

Italy is the clear leader in customers making decisions based on media coverage (Figure 11, see appendix). More than three in four have been influenced by stories about a brand’s ethics (79%) and working conditions (77%). Perhaps this is a result of the country being the EU’s biggest producer of clothing so environmental impact and working conditions are factors that are far closer to home for Italian shoppers.

Trust – winning over the ‘moderately trustful’ half by being kind to workers and nature

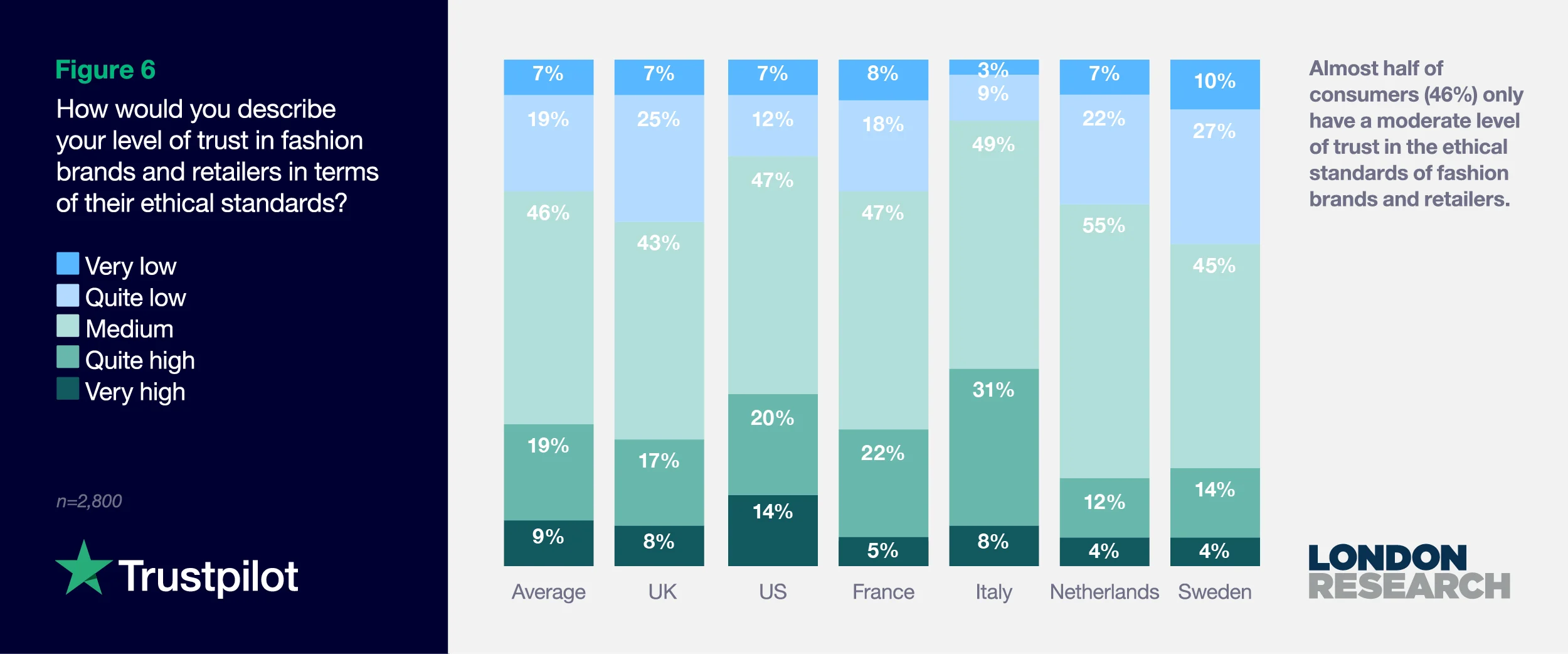

The good news for the industry at large is that more than a quarter of consumers (28%) have a ‘very’ (9%) or ‘quite’ (19%) high level of trust in fashion brands and retailers in terms of their ethical standards (Figure 6).

The bad news is this is negated by a quarter of the market (26%) which has a ‘very’ (7%) or ‘quite’ (19%) low level of trust. This leaves almost half of consumers (46%) sitting on the fence, with only a moderate level of trust in the industry.

With a quarter of the market trusting the industry and a quarter not trusting it, the battleground is clearly winning the hearts and minds of the remainder who are fairly neutral.

Given that four in five respondents have also revealed they are ready to dismiss a brand which treats workers or the environment disrespectfully, the focus should be on convincing customers with a moderate level of trust that a brand is truly committed to treating its workers and the planet with respect.

There are some novel ways of improving trust being deployed at eco-friendly fashion brand SANVT (which means gentle on nature in German). The company’s Head of Marketing and Co-Founder, Benjamin Heyd, reveals the company is dedicated to working with suppliers who use organic cotton and do not use toxic chemicals in the dyeing process. To underline the point, they have an unusual approach to transparency and promotions.

“We keep our environmental impact low and our ethical standards high by using a factory in the EU, in Portugal,” he says.

“We offer a virtual tour of the factory so people can see for themselves the high standards we adhere to. We also don’t run sales promotions, we just offer to plant more trees within our carbon offsetting program when people buy promoted items. I don’t think we’re quite at the point yet where sustainability is the most crucial part of a customer choosing a brand, compared to the design and fit of clothing. However, in the long term, we are definitely getting there and brands will soon need to be able to show consumers they are eco-friendly and ethical.”

Sweden and the Netherlands stand out as the markets with the lowest opinion of fashion brands and retailers. In each market, only 4% trust them highly. France is close behind with a high level of trust reaching just 5%.

The US has the biggest level of ‘very high’ trust in fashion brands and retailers at 14%, backed up by a 20% level of ‘quite high’ trust.

Overall, Italy is the most trusting nation, with more than a third (39%) of consumers having ‘very’ (8%) or ‘quite’ (31%) high trust levels.

Customers need ethical and sustainable fashion brands

It is clear today’s fashion customer is starting to look for more than items that suit their style. In particular, they are committed to avoiding brands found to be acting in a non-ethical and unsustainable way. They are also expecting brands to embrace diversity and inclusivity.

So, what does this mean in practice? What are the strategies, commitments and services modern customers are looking to see more of in the future from fashion brands and retailers? When allowed to suggest three proof points that companies are walking the proverbial walk, what do they pick out?

Joint top, for nearly half of respondents, was commitment to good working conditions throughout the supply chain (46%), along with environmentally-friendly packaging (also 46%). A recycling service (41%) comes in third place, with clothes made from recycled materials (38%) and initiatives aimed at reducing the carbon footprint (36%) completing the top-five wishlist (Figure 7).

Methodology note: Respondents could select up to three options.

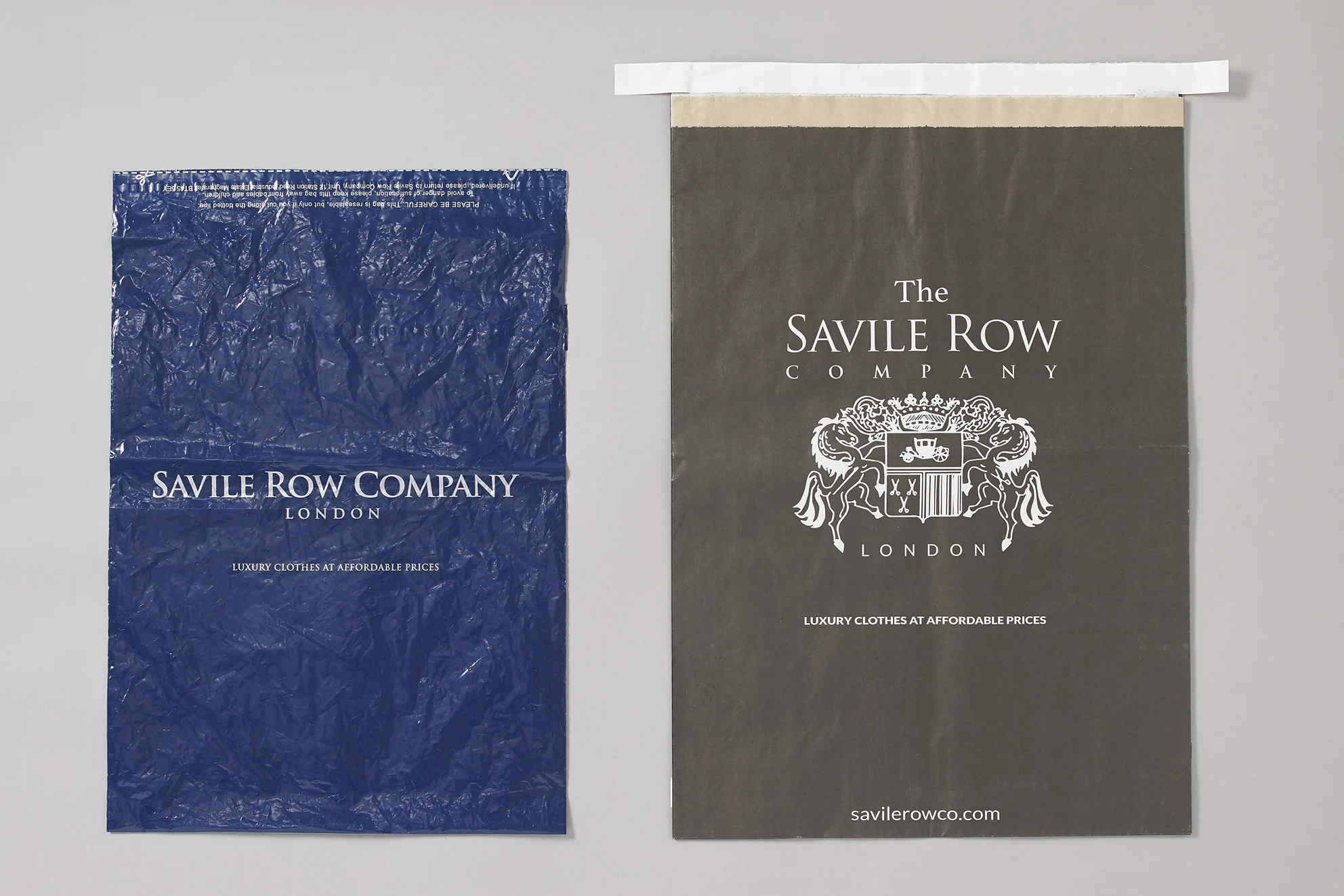

For menswear brand The Savile Row Company, it is not a major surprise that environmentally-friendly packaging tops the list, alongside ethics.

Marketing Director Lee-Anne Harris reveals the business has replaced plastic with biodegradable and potato starch bags, with shirt collars and shoulders held in place by paper fasteners rather than the traditional plastic clips.

“The data we’re getting from our Trustpilot reviews shows customers are reacting well to orders arriving in recyclable paper packaging and a biodegradable bag,” she says.

“We didn’t ask customers first; it was just a no-brainer for us because it’s how we want to live and we were pretty sure it’s how our customers want to live as well. It’s more a question of why wouldn’t you? It’s just a base level of decency.”

The Savile Row Company has replaced plastic packaging (left) with a recyclable paper bag (right).

Despite the uptick in positive reviews, Harris confirms recyclable packaging is still a feature that customers appreciate rather than demand as standard. However, she believes it is only a matter of time before customers “truly hold fashion companies to account for their record on plastic waste”. Hence it makes sense to be prepared in advance.

American customers are way ahead of their European counterparts on the values they want to see from fashion brands and retailers which did not make the top-five list above (Figure 12, see appendix). These include working with charities (35%), offering inclusive product ranges (27%), ensuring diversity in advertising (26%) and taking a stance on social issues (24%).

It is likely a result of the deep social issues Americans are examining in the year the Black Lives Matter (BLM) movement gained massive national, and global, traction. Support for brands taking a stance on social issues, including BLM, is more than twice as high in the US as it is in all other countries surveyed, other than Italy.

How brands can embrace ethics and sustainability

They know their size, they know their style and they have a good idea of what they are starting to want to see from fashion brands and retailers. But what indicators are customers looking for to find out if a brand shares their values on treating people and the environment with dignity and care?

The challenge for companies is there is no single standout attribute consumers are seeking out. Instead, there are four key drivers of trust which are being actively sought out by a little over half (58% and 59%) of fashion shoppers (Figure 8).

Respondents reveal transparent values and policies, fair trade badges and certification, on-site and off-site ratings and reviews are equally as important, on average.

These are areas high on the radar for luxury online fashion retailer FARFETCH. Its Director of Sustainable Business, Thomas Berry, explains the fashion brand not only helps customers make more ethical and sustainable purchases, it also has reselling schemes to extend an item’s life.

“As part of Positively FARFETCH, we have an extensive Conscious collection which customers can shop, using either filters, or our dedicated edits, to ensure they’re getting items that meet good independent sustainability standards and certifications,” he says.

“We also have two service offerings that help our customers extend the life of unused clothes. FARFETCH Second Life is a resale service, where customers submit their old hand-bags, get a price quote, we arrange a pick-up slot and, once the item is verified, the quoted price is added as a credit to their FARFETCH account.

“We do the same with our FARFETCH Donate service, where a customer fills a bag with any fashion item they no longer want, the items are sold in aid of their chosen charity, and customers get a third of the proceeds as FARFETCH credit. In both cases someone else gets to enjoy the items so everyone’s doing their bit to help the environment by reducing overall consumption of 'new' items."

The proof that customers are now looking to make more sustainable and ethical purchasing decisions comes from Berry revealing that the Conscious range is growing at a significantly faster rate than all other sales through the site. Additionally, across the industry, he estimates new clothes sales are predicted to grow at most around 3% whereas clothing resale growth is in the 15%-30% range.

Conclusion

The primary motivators in fashion will likely always be the look, feel, design and price of an item. However, there is a growing consideration to filter fashion brands and retailers according to their action on sustainability and ethics.

This was always bubbling under the surface but it would appear the global pandemic has prompted consumers to take stock of what is important and to value brands who treat their workers and the environment with care and respect.

Research coordinated by Cardiff University found, for example, that the proportion of Britons who believe tackling climate change is urgent rose from 62% to 74% between August 2019 and August 2020. Additionally, nearly half the UK population (47%) is now vowing to fly less than before once restrictions are lifted. In the US, media reports have suggested taking a step back from the daily grind of driving to work has seen air pollution drop by 30%.

These issues should resonate with fashion brands and retailers, given that four in five consumers reveal they would not shop with a brand that lacked ethical and sustainable values. Hence, half of consumers have already revealed they have avoided fashion companies that have received poor media coverage over their ethics and sustainability record.

Consumers have spoken clearly. They want brands to:

Treat workers throughout their entire supply chain fairly

Produce clothes without damaging the environment

Use recyclable packaging

Embrace recycling schemes which extend garments’ lives

Work hard on carbon reduction measures

Operate according to transparent brand values

These are the action points fashion brands and retailers need to embrace to win over the half of the market that currently only trusts the industry to a moderate degree and the quarter which does not trust them at all.

When it comes to trust, they need to remember fashion shoppers highly trust one another’s advice and online reviews two to three times as much as glossy magazine articles, social media and advertising. As for celebrity influencers, these are the least trusted source available to fashion marketers.

The message is clear. Consumers want to see sustainable and ethical fashion, and they place their trust on which brands match these values in word of mouth and reviews, not the media and most definitely not on what celebrity influencers are paid to say.

If you'd like to find out more about Trustpilot, and how social proof can help you build trust with consumers, request a free demo below.

Methodology

London Research was commissioned by Trustpilot to carry out surveys of 2,800 nationally representative consumers across the UK (n=1,000), US (n=1,000), France (n=200), the Netherlands (n=200), Italy (n=200) and Sweden (n=200) in September 2020.

The research was conducted using a Toluna research panel. London Research also carried out a series of interviews for this report.

Acknowledgements

London Research and Trustpilot would like to thank the following people for their help in compiling this report:

Thomas Berry, Global Director of Sustainable Business, FARFETCH

Lee-Anne Harris, Marketing Director, The Savile Row Company

Benjamin Heyd, Head of Marketing and Co-Founder, SANVT

Olivia Pinnock, Fashion Writer and Creator of The Fashion Debates

Sophie Slater, Co-Founder, Birdsong

Laurel Wolfe, VP Marketing, Klarna